Harvesting a deep blue ocean of innovation to revolutionize healthcare.

First, because it is part of our DNA. What drives us as individuals and as an organization is the desire to make a difference. Ultimately we are looking to increase longevity and improve people’s quality of life by partnering with companies that Accelerate Cure.

As investors our goal is to produce exceptional returns for our LPs. However, what makes us different is that we don’t look at financial returns in isolation, but rather as the natural product of an investment in a company that is successful at solving healthcare’s greatest challenges. This is what creates sustainable value and makes aMoon’s mission inherently impactful.

Second, because our focus on impact allows us to form a common language with our partners and stakeholders. When we connect with scientists, physicians, and entrepreneurs we do so through the language of science, healthcare outcomes, quality and efficiency. This common language is what connects us more deeply to the key innovators in the healthcare value chain. When we do that, we become better informed. We run smarter diligence processes and find more ways to add value to our portfolio companies. In short, we become better investors.

Finally, we believe that most, if not all, of our LPs care deeply about achieving multiple objectives – accelerating cure, generating excellent financial returns and having societal impact. By aligning across these elements it helps us to develop a stronger relationship with our limited partners and be more thoughtful with our communication.

We think about impact in several ways. First, impact has to be measurable and easy to understand. Second, it has to be connected to a larger mission and resonate with stakeholders. Third, it needs to move from the macro to the micro and ‘meet the individual’ by touching lives.

In venture capital, we believe that impact needs to be measured in three phases –innovation, commercialization, and scale. We start our analysis of impact by looking at the end result – societal impact – what we call scale. When we think about scale, we are interested in measuring substantial impact on longevity and quality of life, scientific progression and better healthcare delivery, alongside substantial value for stakeholders.

We think about impact in several ways. First, impact has to be measurable and easy to understand. Second, it has to be connected to a larger mission and resonate with stakeholders. Third, it needs to move from the macro to the micro and ‘meet the individual’ by touching lives.

In Venture Capital, we believe that impact needs to be measured in three phases –innovation, commercialization, and scale. We start our analysis of impact by looking at the end result, societal Impact, what we call scale. When we think about scale, we are interested in measuring substantial impact on longevity and quality of life, scientific progression and better healthcare delivery, alongside substantial value for stakeholders.

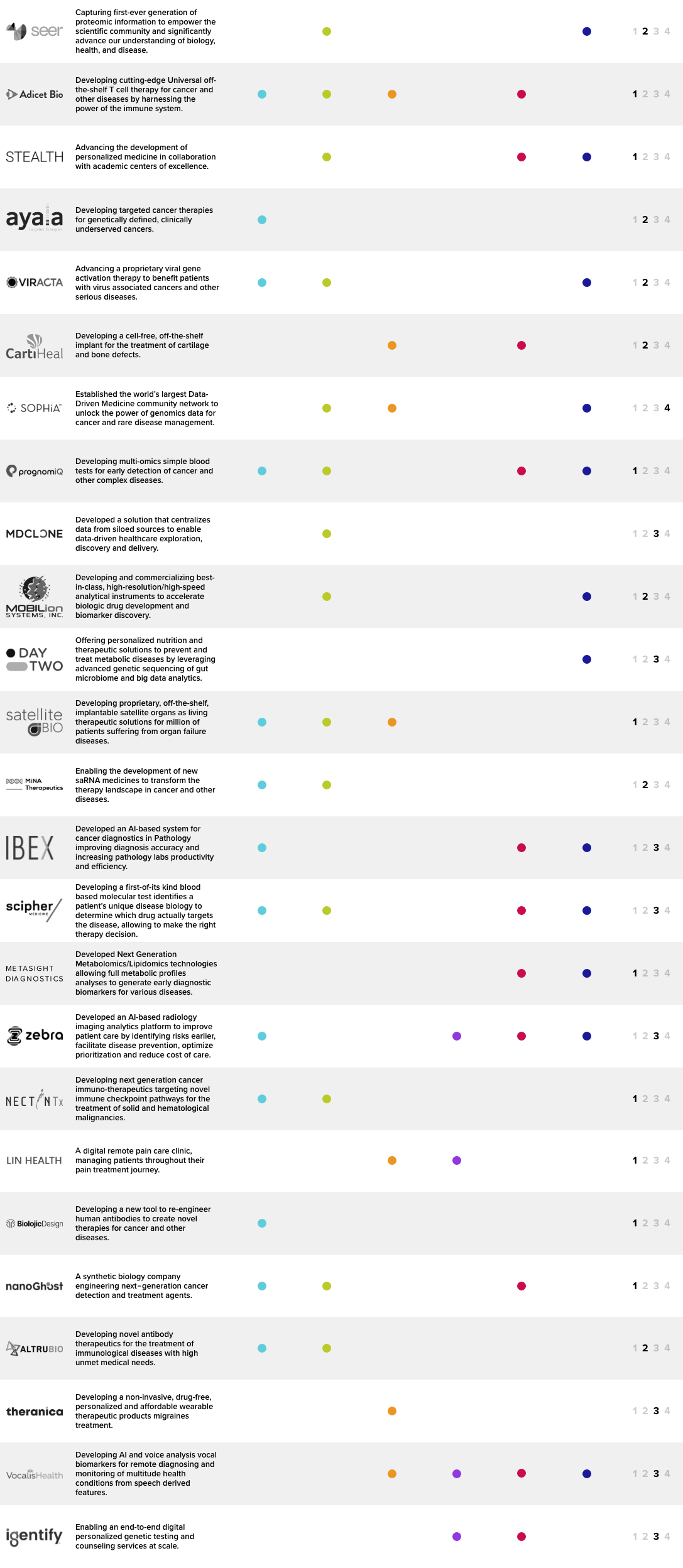

Our impact assessment manifests across the entire investment cycle; from screening, through investing to monitoring our portfolio. We have defined six impact pillars that derive from our mission to accelerate cure.

Save life or meaningfully extend life: innovations that can cure diseases and save lives through breakthrough treatments.

Enabling the development of groundbreaking technologies transforming the way we diagnose and treat severe disease.

Improve the quality of life for those with chronic diseases: treatments for some of the most challenging unmet needs.

Better access to healthcare: we back cutting-edge technologies to democratize healthcare and ensure access to affordable, quality health services for all.

Reduce healthcare costs: as healthcare costs rise to unsustainable levels we focus on increasing institutions’ capacity and cutting costs.

Promote predictive and personalized medicine, and new ways of delivering healthcare: from reactive to predictive, from treatment to prevention, from generic to personalized.

Generating this degree of societal impact is predicated on achieving commercial success which, in turn, is driven by great product market fit, market access and relentless execution. As a young investment platform, most of our companies are still in the pre-commercial stage and over time they will advance to the commercialization and scale phases.

IMPACT STAGE

1 Early Development

2 Late Development

3 Early Commercialization

4 Late Commercialization

IMPACT STAGE

1 Early Development

2 Late Development

3 Early Commercialization

4 Late Commercialization

Generating this degree of societal impact is predicated on achieving commercial success which, in turn, is driven by great product market fit, market access and relentless execution. As a young investment platform, most of our companies are still in the pre-commercial stage and over time they will advance to the commercialization and scale phase.

To measure innovation we look at indicators such as active clinical programs, quality of academic collaborations and size of R&D investments.

On the commercialization front, besides analyzing metrics such as units sold and revenues, we also look at indicators such as number of approvals, number of innovative products launched, number of treatments/tests administered.

On the scale front, we look through two lenses: 1) Breadth – how scalable is the solution and how many people and lives can we touch? And 2) Depth – how fundamental and deep is the impact? We look at measures such as survival improvements and improved disease control rates for those living with chronic diseases. We will also look to measure the impact our portfolio companies are having in terms of promoting predictive and personalized medicine. Finally, we will attempt to quantify how our portfolio companies are succeeding in reducing healthcare costs and improving efficiency of care delivery as well as provide some macroeconomic perspectives on measures such as the number of jobs created and market value created.

Strategic analysis,

prioritization and planning

Business development: partnerships, customers, new markets

Financing strategy & fundraising

Talent hunting & placement

Positioning, marketing, PR and storytelling

Magnifying our impact by supporting our portfolio companies.

We focus on impact both on the portfolio level and the investor level. As an investor, we have an enormous opportunity to enhance our portfolio’s impact by adding value and accelerating our portfolio’s growth as early as the diligence process all the way through the investment and value creation journey.

aMoon Alpha is our in-house team dedicated to strengthening our portfolio company’s execution capabilities and unlocking additional value creation opportunities. Through Alpha, we tap aMoon’s global network and talent capabilities to offer our portfolio companies tailored access to global capital markets, leading research and scientific institutions, strategic collaborators, and customers. aMoon Alpha, together with our investment teams, equips entrepreneurs with the expertise, networks, connections, resources, and support they need to accelerate their path to value creation so they can build world-leading companies.